Have you ever wondered what drives the fluctuations in gold prices? As you look into the factors, you’ll find that elements like inflation rates, currency stability, and central bank policies play significant roles. For instance, during periods of high inflation, you might notice gold prices climbing as investors seek a safe haven for their assets. Similarly, when the dollar weakens, gold often becomes cheaper for investors holding other currencies, thereby increasing demand. But that’s just the tip of the iceberg. Consider how shifts in market dynamics or geopolitical tensions could further influence these prices. What do you think happens then?

Have you ever wondered what drives the fluctuations in gold prices? As you look into the factors, you’ll find that elements like inflation rates, currency stability, and central bank policies play significant roles. For instance, during periods of high inflation, you might notice gold prices climbing as investors seek a safe haven for their assets. Similarly, when the dollar weakens, gold often becomes cheaper for investors holding other currencies, thereby increasing demand. But that’s just the tip of the iceberg. Consider how shifts in market dynamics or geopolitical tensions could further influence these prices. What do you think happens then?

Global Economic Indicators

Several global economic indicators significantly impact gold prices, including inflation rates, currency values, and interest rates.

When inflation surges, you’ll often see gold prices climb as well. That’s because gold is considered a hedge against inflation; it retains value even when currency values fall.

Speaking of currencies, the strength of the dollar plays a crucial role too. If the dollar weakens, gold becomes cheaper for investors holding other currencies, which can drive up demand and, consequently, the price.

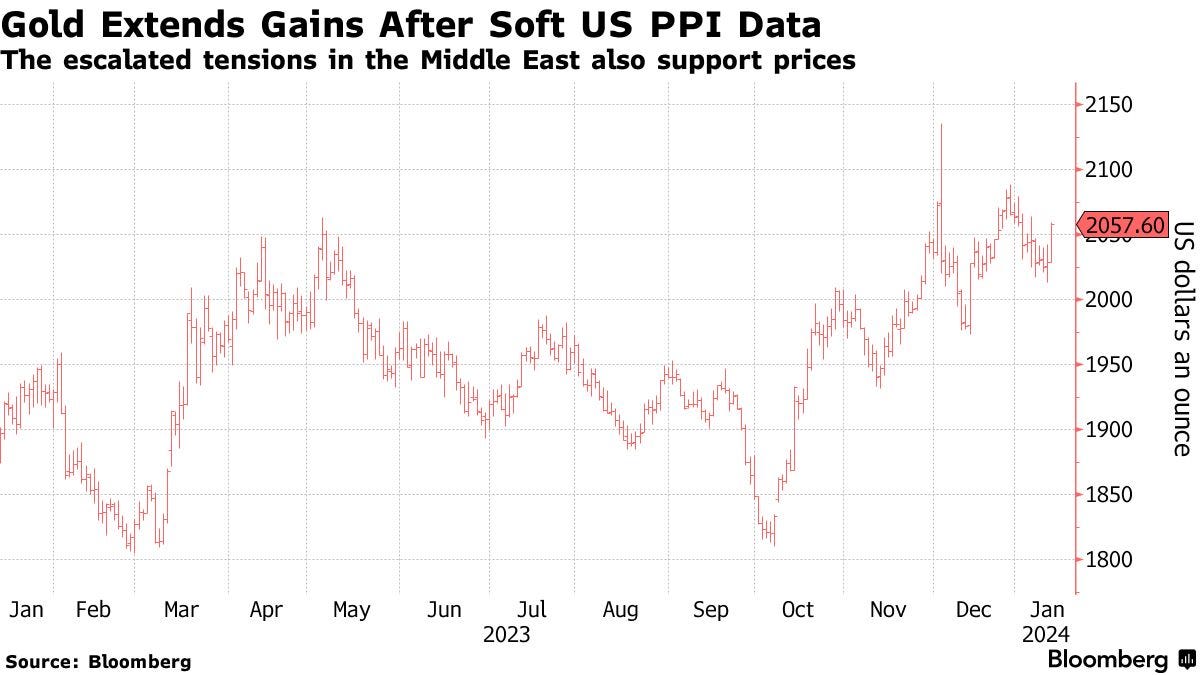

Meanwhile, interest rates inversely affect gold’s allure. As rates rise, higher-yielding investments like bonds attract more investors, reducing the appeal of non-yielding assets like gold. So, you’d see gold’s price typically drop in a high-interest rate environment.

Central Bank Reserves

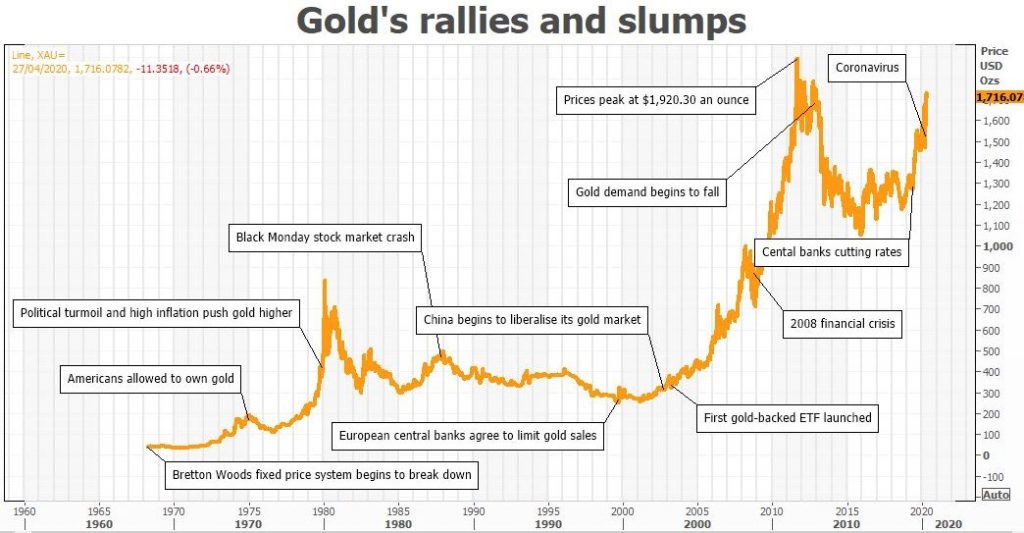

While global economic indicators like interest rates influence gold prices, central bank reserves also play a significant role in determining its value.

You’ve probably noticed that when central banks, such as the Federal Reserve or the European Central Bank, adjust their gold reserves, market prices tend to react. This is because these institutions hold significant amounts of gold to back their currencies and manage economic stability.

When they buy more gold, you’ll see the demand increase, pushing prices up. Conversely, if they sell off gold, there’s a surge in supply, which can lower prices.

You’re witnessing a powerful tug-of-war, where these financial behemoths’ actions directly impact your investments in gold.

Inflation and Currency Values

Inflation and shifts in currency values significantly influence gold prices, impacting your investment decisions. When inflation rises, the value of currency tends to drop. This makes gold, which maintains its value, an attractive investment. It’s a hedge against the decreasing purchasing power of money. As you see inflation climbing, you might notice gold prices going up as more investors turn to gold as a safer asset.

Similarly, when the currency of a major economy weakens, global investors often move their funds into gold. This increased demand boosts gold prices. Conversely, a strong currency can lead to lower gold prices as investors find more strength in holding cash or other investments. Understanding these dynamics can help you make smarter decisions in diversifying your portfolio.

Gold Production and Supply

You’re also impacted by how quickly and efficiently gold can be extracted and processed. Advances in technology can reduce production costs, thus potentially lowering prices. However, environmental regulations and political instability in gold-rich regions can disrupt supply chains, causing spikes in market prices.

Gold production and supply levels significantly dictate market prices and your investment potential. When mines produce more gold, the increase in supply can lead to lower prices if demand doesn’t rise to meet it. Conversely, if production slows due to factors like labor strikes or regulatory changes, you might see prices climb as supply tightens.

Keep in mind, the availability of scrap gold from recycling also supplements supply, adding another layer to consider in your investment strategy.

Market Demand and Investment Trends

Understanding market demand and investment trends is key to anticipating how gold prices will react in various economic environments. As you delve into the dynamics of gold investment, you’ll find that investor behavior significantly influences market demand. When economic uncertainty rises, investors often flock to gold as a ‘safe haven.’ This increased demand can drive up gold prices. Conversely, when stock markets are booming and confidence is high, gold may see less investor interest, potentially lowering its price.

Moreover, trends in gold investment, such as the popularity of gold-backed ETFs, also play a crucial role. These funds make it easier for you to invest in gold without physically holding the metal, thus broadening the market and possibly affecting prices due to changes in investment flows.

Frequently Asked Questions

How Does Gold Recycling Impact Its Market Price?

Gold recycling reduces the need for mining by providing existing gold back to the market. This can lower production costs and stabilize prices. It impacts supply, potentially affecting market dynamics. This process plays a crucial role in sustainable resource management. It helps in conserving natural resources and reducing the environmental impact of mining activities.

Can Geopolitical Tensions Influence Gold Prices?

Yes, you’ll find geopolitical tensions can indeed influence gold prices. When instability rises, investors often turn to gold as a safe haven, pushing its value up as demand increases.

What Role Does Jewelry Demand Play in Gold Pricing?

You’ll find that jewelry demand significantly impacts gold prices.

When more people want gold for jewelry, prices go up due to increased demand.

It’s a straightforward supply and demand situation.

How Do Seasonal Trends Affect Gold Prices?

Seasonal trends significantly sway gold prices, as demand often spikes during certain holiday periods globally, influencing market dynamics.

You’ll notice these fluctuations typically around major gift-giving seasons like Christmas or Diwali.

Conclusion

You’ve seen how gold’s price is swayed by several key factors. Global economic indicators and central bank reserves significantly influence its value, as do inflation and currency fluctuations.

Moreover, gold production and supply constraints can tighten the market, while shifts in market demand and investment trends often reflect broader economic sentiments.

Understanding these dynamics helps you grasp why gold remains a sought-after asset, especially during times of financial uncertainty. Keep an eye on these factors to navigate the gold market effectively.

Pingback: 7 Tips for Buying Gold in 2024 - Digital Gold Company